By nature, CFOs and their direct reports are confident in their abilities to wrangle budgets, contain and cut costs.

And judging from my experience, they should be: they’re some of the most analytical, and knowledgeable people with whom I’ve had the privilege to work.

Still, there are certain projects that demand more resources than what many mid-market firm CFOs and their staffs can muster. Chief among these kinds of projects: corporate-wide cost reduction campaigns.

Here are three reasons why you should hire a third party to lead your next cost-reduction campaign.

1. Access to a Focused Team

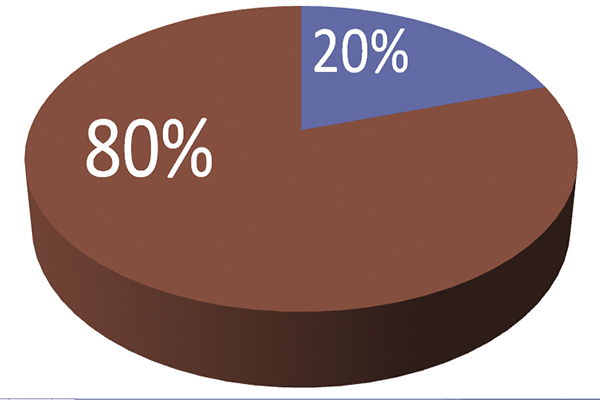

At Vantage, we find that most of our clients are trying to “do more with less” and focus on the 80/20 rule of spend management, which says that 80% of spend is made up of only 20% of suppliers. Our aim is to fill in the gaps and provide the resources to cover the remaining 20% of spend that is made up of 80% of suppliers that are fragmented throughout the organization.

Don Vandoski, founder of Vantage Cost, spent the majority if his career on your side of the desk and he said that, “We had to stretch goals every year to address most of our spend, but the reality is that we couldn’t get to all of it.”

See what our clients have to say.

2. Access to Category Experts

Most companies address specific indirect spend categories every few years, as contract terms expire. Consulting firms such as Vantage have to execute sourcing events every day, and build knowledge of best practices for a wide range of indirect expense categories. Many of our consultants have experience on the supply side and understand what suppliers need to get deals done on contracts that are priced below pre-approved offerings.

3. Access to Industry Benchmark Data

A leading, publicly traded distributor engaged Vantage Cost to help them with a cost-containment project. Vantage identified and implemented nearly $1.6 million in total cost savings.

At the end of our engagement, the CFO recognized the importance of having a third party lead the savings effort. Citing payroll processing as an example, he observed that if his firm had tackled the area themselves, they would have been happy with the 10 percent reduction the incumbent supplier initially offered.

But Vantage Cost pressed for a second round of negotiations, achieving a 27 percent reduction. How? We used our industry benchmark data—data many mid-market firms don’t have access to—and negotiated for deeper savings. The CFO realized he would have left 17 percent savings on the table.

Want to read the whole case study? Click here for more information.

photo credit: attivitoso via photopin cc