THE government of Slovenia, insists Alenka Bratusek, the prime minister of eight months, can set its country’s finances to rights without having to seek a bail-out from the euro zone and the IMF. Having seen the harsh conditions imposed on the previous supplicants, she is determined that Slovenia should chart its own course and says that her government can carry out all the necessary reforms on its own.Whether she is right will soon be revealed. In early December an independent audit and stress tests of the country’s troubled banks will disclose just how short of capital they are. Unlike Cyprus, which this spring became the fifth euro-zone state to require a rescue, Slovenia has a relatively small banking industry, with assets worth around 130% of GDP compared with the Cypriot banks’ 800%. But this offers scant comfort since the three biggest Slovenian banks are bust, able to keep operating only because of the imminent prospect of recapitalisation.

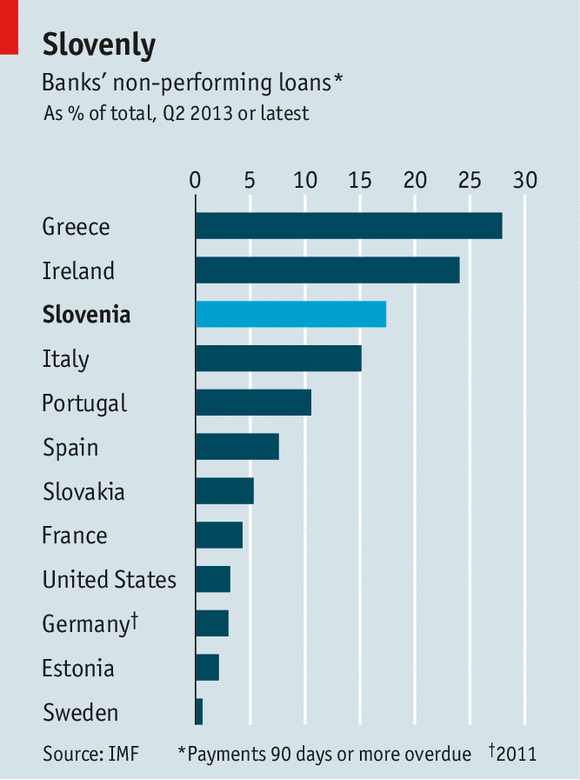

The banks’ plight arises from mounting losses on their loans. Between the middle of 2012 and of 2013, the ratio of non-performing to total loans rose from 13.2% to 17.4%, which is the highest level in the…