Note: This is the first in a three-part series on the different types of CFOs, CEOs, and how they can best communicate with each other. In this post, we outline the four different types of CFOs. In post two, we’ll outline the four different types of CEOs. The third post will offer tips toward better, more clear CFO and CEO communication.

Every CFO, like every leader, has their own executive style. Some are dyed-in-the-wool cost cutters, with a preternatural skill of haggling vendors for the best deals. Others, meanwhile, excel at growth-minded value creation, with their 5-year projections and treasury analyses carefully plotted on the nearest whiteboard in their office or spreadsheet on their laptop.

Each style brings with it a different set of advantages and disadvantages, strengths and weaknesses. But one of the most important aspects of assessing which type of CFO you are is understanding how to mesh that style with your CEO (Don’t forget: your effectiveness is directly linked to the quality of that relationship.)

In an excellent January 2013 article, McKinsey consultants Ankur Agrawal, John Goldie, and Bill Huyett outlined four types of CFOs. We build on their work, and offer tips on how CFOs can best work with their CEO—while offering a few strengths and weaknesses of each type.

1. The Cost-Cutter

Quintessential “numbers people,” these types are a throwback to the old model of CFO: Their primary concern isn’t the growth of the company’s revenues; instead, it’s only on one side of the equation: expenditures.

Quintessential “numbers people,” these types are a throwback to the old model of CFO: Their primary concern isn’t the growth of the company’s revenues; instead, it’s only on one side of the equation: expenditures.

Brandishing a kind of fiscal bunker mentality, they fail to see that their jobs can not only keep their company afloat financially, but actually grow and expand it. Still, they’re content to stay in their lane and execute traditional responsibilities around financial reporting, auditing and compliance.

The cost-cutter is focused only on one-side of the equation. They have an inability to see how their role fits into a company’s bigger picture. They focus on cutting costs company wide, in addition to responsibilities such as planning, treasury and capital structure.

2. The Scorecard CFO

Numbers, metrics, projections. These are the native language of the Scorecard CFO. As McKinsey notes, dubbing them “performance leaders,”: “they tend to focus on cost management, to promote the use of metrics and scorecards, and to work to standardize data and systems. They are often hired externally, and many have previous experience as CFOs.” They are also generalists, as McKinsey calls them, and likely to have an MBA.

Numbers, metrics, projections. These are the native language of the Scorecard CFO. As McKinsey notes, dubbing them “performance leaders,”: “they tend to focus on cost management, to promote the use of metrics and scorecards, and to work to standardize data and systems. They are often hired externally, and many have previous experience as CFOs.” They are also generalists, as McKinsey calls them, and likely to have an MBA.

Scorecard CFOs, by virtue of their way to measure their way toward success, get along well with virtually all kinds of CEOs. Because of their need to keep tabs on and manage everything, they may risk taking on too many of the CEOs’ pet projects.

3. The Finance Functionalist

These CFOs, according to McKinsey, typically rise through the ranks of their organization, unlike CFOs who are hired externally. They pair their hard-won institutional knowledge with a strong core of financial knowledge—a powerful combination. They are most common in companies who lack a strong financial department. McKinsey notes that these types of CFOs typically have advanced accounting degrees or experience in auditing.

These CFOs, according to McKinsey, typically rise through the ranks of their organization, unlike CFOs who are hired externally. They pair their hard-won institutional knowledge with a strong core of financial knowledge—a powerful combination. They are most common in companies who lack a strong financial department. McKinsey notes that these types of CFOs typically have advanced accounting degrees or experience in auditing.

4. The Growth Guru

These CFOs are often external hires, and come into the organization with a good understanding of best practices culled from their experience that spans multiple firms. They may bring to the table valuable experience in mergers and acquisitions, according to McKinsey. And they likley have a background in one of three careers, the authors note: “Many growth champions are among the nearly one-third of new CFOs who have spent a sizable portion of their career in investment banking, consulting, or private equity, up from one-fifth with a similar background prior to 2009.”

These CFOs are often external hires, and come into the organization with a good understanding of best practices culled from their experience that spans multiple firms. They may bring to the table valuable experience in mergers and acquisitions, according to McKinsey. And they likley have a background in one of three careers, the authors note: “Many growth champions are among the nearly one-third of new CFOs who have spent a sizable portion of their career in investment banking, consulting, or private equity, up from one-fifth with a similar background prior to 2009.”

Which type of CFO are you? How can you improve the way you relate to your CEO?

$100 bill photo credit: Tax Credits via photopin cc

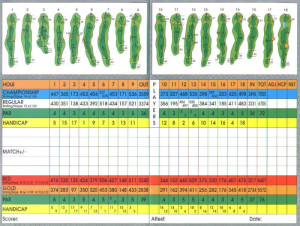

Score card photo credit: danperry.com via photopin cc

Skyscraper photo credit: paul bica via photopin cc

Bull photo credit: David Paul Ohmer via photopin cc